Extension For Estate Tax Return . When and how to lodge a trust tax return, income to include, how tax applies,. learn how to use form 4768 to apply for an automatic or discretionary extension of time to file and/or pay u.s. doing trust tax returns for the deceased estate. to effectively manage the deceased estate tax return and cgt obligations, executors and beneficiaries should follow these steps: Application for extension of time to file a. Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. February 2020) department of the treasury internal revenue service. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. capital gains tax (cgt) can have significant implications for deceased estates, particularly concerning the.

from www.formsbank.com

When and how to lodge a trust tax return, income to include, how tax applies,. learn how to use form 4768 to apply for an automatic or discretionary extension of time to file and/or pay u.s. to effectively manage the deceased estate tax return and cgt obligations, executors and beneficiaries should follow these steps: Application for extension of time to file a. doing trust tax returns for the deceased estate. capital gains tax (cgt) can have significant implications for deceased estates, particularly concerning the. Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. February 2020) department of the treasury internal revenue service. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in.

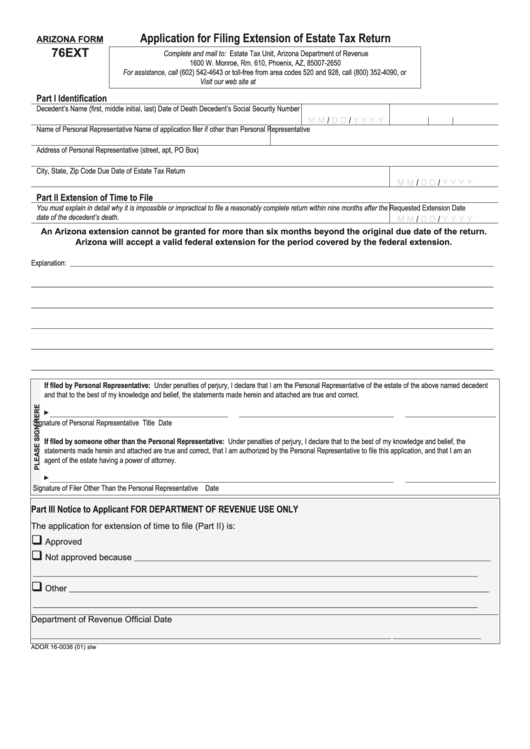

Form 76ext Application For Filing Extension Of Estate Tax Return

Extension For Estate Tax Return When and how to lodge a trust tax return, income to include, how tax applies,. doing trust tax returns for the deceased estate. capital gains tax (cgt) can have significant implications for deceased estates, particularly concerning the. to effectively manage the deceased estate tax return and cgt obligations, executors and beneficiaries should follow these steps: for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. learn how to use form 4768 to apply for an automatic or discretionary extension of time to file and/or pay u.s. Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. February 2020) department of the treasury internal revenue service. When and how to lodge a trust tax return, income to include, how tax applies,. Application for extension of time to file a.

From www.formsbirds.com

Estate Tax 23 Free Templates in PDF, Word, Excel Download Extension For Estate Tax Return learn how to use form 4768 to apply for an automatic or discretionary extension of time to file and/or pay u.s. Application for extension of time to file a. When and how to lodge a trust tax return, income to include, how tax applies,. doing trust tax returns for the deceased estate. February 2020) department of the treasury. Extension For Estate Tax Return.

From www.slideserve.com

PPT What Are the Extensions of Time to Pay Estate Tax? PowerPoint Extension For Estate Tax Return Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. When and how to lodge a trust tax return, income to include, how tax applies,. Application for extension of time to file a. February 2020) department of the treasury internal revenue service. capital gains tax (cgt) can have significant implications. Extension For Estate Tax Return.

From www.formsbank.com

Form 76ext Application For Filing Extension Of Estate Tax Return Extension For Estate Tax Return Application for extension of time to file a. doing trust tax returns for the deceased estate. February 2020) department of the treasury internal revenue service. capital gains tax (cgt) can have significant implications for deceased estates, particularly concerning the. Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary.. Extension For Estate Tax Return.

From www.formsbank.com

Estate Tax Form 24 Application For Extension Of Time To File Ohio Extension For Estate Tax Return to effectively manage the deceased estate tax return and cgt obligations, executors and beneficiaries should follow these steps: for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. doing trust tax returns for the deceased estate. February 2020) department of the treasury internal. Extension For Estate Tax Return.

From www.formsbank.com

Fillable Form Pv86 Estate Tax Extension Payment printable pdf download Extension For Estate Tax Return When and how to lodge a trust tax return, income to include, how tax applies,. to effectively manage the deceased estate tax return and cgt obligations, executors and beneficiaries should follow these steps: doing trust tax returns for the deceased estate. capital gains tax (cgt) can have significant implications for deceased estates, particularly concerning the. learn. Extension For Estate Tax Return.

From www.formsbirds.com

Form 4768 Application for Extension of Time To File a Return and/or Extension For Estate Tax Return Application for extension of time to file a. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. capital gains tax (cgt) can have significant. Extension For Estate Tax Return.

From www.teachmepersonalfinance.com

IRS Form 4768 Instructions Extensions For Estate Tax Returns Extension For Estate Tax Return doing trust tax returns for the deceased estate. learn how to use form 4768 to apply for an automatic or discretionary extension of time to file and/or pay u.s. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. to effectively manage. Extension For Estate Tax Return.

From www.formsbank.com

Fillable Form Et 24 Application For Extension Of Time To File Ohio Extension For Estate Tax Return When and how to lodge a trust tax return, income to include, how tax applies,. to effectively manage the deceased estate tax return and cgt obligations, executors and beneficiaries should follow these steps: Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. capital gains tax (cgt) can have. Extension For Estate Tax Return.

From www.dochub.com

New york state estate tax return extension Fill out & sign online DocHub Extension For Estate Tax Return When and how to lodge a trust tax return, income to include, how tax applies,. Application for extension of time to file a. February 2020) department of the treasury internal revenue service. doing trust tax returns for the deceased estate. for the first 3 income years of a deceased estate, you must lodge a trust tax return if. Extension For Estate Tax Return.

From www.formsbank.com

Form Nh 706 New Hampshire Estate Tax Return printable pdf download Extension For Estate Tax Return Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. Application for extension of time to file a. February 2020) department of the treasury internal revenue. Extension For Estate Tax Return.

From www.ramseysolutions.com

How to File a Tax Extension in 2024 Ramsey Extension For Estate Tax Return Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. learn how to use form 4768 to apply for an automatic or discretionary extension of. Extension For Estate Tax Return.

From www.teachmepersonalfinance.com

IRS Form 4768 Instructions Extensions For Estate Tax Returns Extension For Estate Tax Return Now that you have collected all the estate assets and paid all outstanding debts, you can complete the necessary. doing trust tax returns for the deceased estate. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. capital gains tax (cgt) can have. Extension For Estate Tax Return.

From troyfisher341buzz.blogspot.com

How To File An Extension For State Taxes In California Extension For Estate Tax Return February 2020) department of the treasury internal revenue service. doing trust tax returns for the deceased estate. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. When and how to lodge a trust tax return, income to include, how tax applies,. to. Extension For Estate Tax Return.

From www.zenledger.io

How to File a Tax Extension? ZenLedger Extension For Estate Tax Return capital gains tax (cgt) can have significant implications for deceased estates, particularly concerning the. Application for extension of time to file a. When and how to lodge a trust tax return, income to include, how tax applies,. to effectively manage the deceased estate tax return and cgt obligations, executors and beneficiaries should follow these steps: for the. Extension For Estate Tax Return.

From www.philippinetaxationguro.com

Estate Tax Amnesty Extension 2022 in the Philippines TAXGURO Extension For Estate Tax Return When and how to lodge a trust tax return, income to include, how tax applies,. capital gains tax (cgt) can have significant implications for deceased estates, particularly concerning the. doing trust tax returns for the deceased estate. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of. Extension For Estate Tax Return.

From www.wsj.com

Getting A Tax Return Extension With The IRS Extension For Estate Tax Return February 2020) department of the treasury internal revenue service. Application for extension of time to file a. When and how to lodge a trust tax return, income to include, how tax applies,. for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. doing trust. Extension For Estate Tax Return.

From www.antonelli-legal.com

Estate Tax Returns, Extensions, Audits New York City Estate Planning Extension For Estate Tax Return for the first 3 income years of a deceased estate, you must lodge a trust tax return if any of the following apply in. learn how to use form 4768 to apply for an automatic or discretionary extension of time to file and/or pay u.s. When and how to lodge a trust tax return, income to include, how. Extension For Estate Tax Return.

From www.financestrategists.com

How to File Taxes for an Estate Steps to Filing and Tax Extension For Estate Tax Return February 2020) department of the treasury internal revenue service. learn how to use form 4768 to apply for an automatic or discretionary extension of time to file and/or pay u.s. When and how to lodge a trust tax return, income to include, how tax applies,. doing trust tax returns for the deceased estate. to effectively manage the. Extension For Estate Tax Return.